Get a better deal on your debts, refinance your car loan

Article in partnership with Driva.

With the New Year upon us, many people are still riding the crest of the big and beautiful wave which is their resolution. While for some that means shedding some unwanted kilos, for many it will also mean freeing themselves of another type of unwanted weight: debt.

In order to achieve this, you will need to manage your cash flow. That means making sure you're not wasting money or needlessly paying more for things than is necessary, which includes debt repayments!

If you had a poor credit score or weren't particularly sage when seeking finance, chances are, you're probably paying higher interest rates, higher fees, and ultimately higher monthly repayments than you ought to be.

This can trap you in a debt cycle that seems hard to get out of. After all, so much of your paycheck is disappearing each week before you even get to see it. However, this doesn't need to be permanent.

By refinancing your debts, especially expensive debts like your car loan, you could save significant amounts of money each year.

So, what is refinancing?

Refinancing is simply the process of switching from one loan provider to another. It can be particularly advantageous when it comes to debts such as car loans, especially if you didn't shop around or receive a competitive rate when you signed up for it.

By refinancing your car loan with a service like Driva, you could save thousands of dollars over the life of the loan, depending on how much you initially borrowed and the new rate you're eligible for.

Ultimately, refinancing is about taking back control of your finances and finding a new arrangement that works for you.

Obviously, for different people, that will mean different things. But, it can have some distinct advantages.

What are the benefits of refinancing a car loan?

1 - Lower interest rates

For some people, the biggest issue with their current loan is that the interest rate is simply too high. By refinancing, you can shop around to find a new lender that is prepared to offer a more competitive interest rate, which in turn can lead to a reduction in your monthly repayments.

2 - Extending the loan to reduce your repayments

If you can't achieve a better interest rate - which isn't always possible - but you're struggling with the current repayment, refinancing can still be a good short term solution. By refinancing, you can extend the term of the loan, which will allow you to reduce your monthly repayments.

While this isn't ideal in the long term - that is to say it will cost you more and take longer to pay the loan off - it can be advantageous if you're simply looking to free up some extra cash in your budget.

3 - Getting a better deal

Another massive advantage of refinancing is that it simply allows you to shop around for a better deal. This includes being able to find a loan with a better fee structure - especially if you're being charged excessive fees by your current lender - and achieving more flexible loan conditions.

For example, you might want to change your repayment schedules or have the option to make extra repayments without incurring fees. You may even want the ability to add a 'balloon payment' to the end of your loan.

4 - Paying off your loan quicker

If your financial situation has improved since you took out your car loan, you may want to pay it off as soon as possible. Refinancing can allow you to increase your monthly repayments and shorten the term of the loan, thus reducing the time it will take to pay off as well as your overall interest. This can also save you serious money in the long term.

5 - Taking advantage of your better credit score

Perhaps most importantly, refinancing can help you take advantage of your improved credit score to achieve a more favourable arrangement.

One of the most common reasons people get stuck with bad loans is because they had a poorer credit score when they applied for the loan. However, if your score has improved, then refinancing is definitely an option worth looking into.

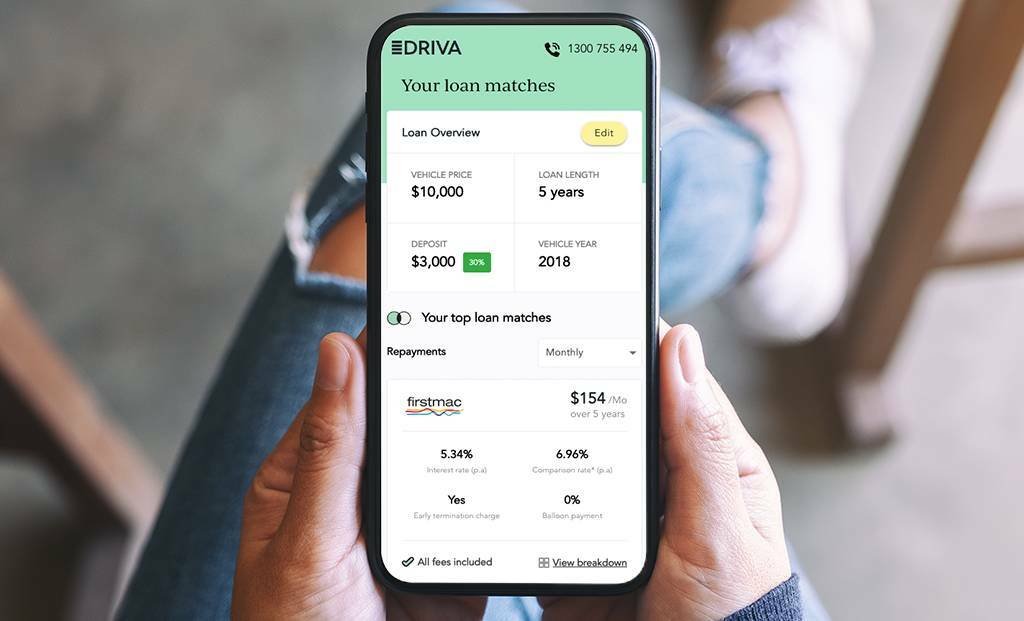

If you refinance with Driva, their smart refinancing platform will use your current credit profile to provide you with personalised quotes from a selection of their 30+ lenders. You'll also need to tell them a few details about you, your current loan balance, and the age of your vehicle.

Driva will then be able to provide you with personalised rates that you're pre-qualified for. Plus, all of the rates you see are fully inclusive of fees and charges, so the amount displayed is exactly what would come out of your account each month.

However, refinancing isn't suitable for everyone

If you only have a year or less on your current loan, it might not be worth refinancing since many lenders will charge an exit or entry fee. If you don't have very long to go on your loan you should make sure that refinancing your loan is financially worth it.

If you're not in a relatively strong financial position, you might also struggle to find a lender that will approve your loan application.

Finally, you'll need to consider what the value of your car is before you refinance. Cars, depreciate over time. So, your car is most likely be worth less than what you paid for it.

In order to have the best chance of refinancing, it's a good idea to ensure that your car is currently worth more than what you currently owe.

Conclusion

Refinancing can be highly advantageous if you're looking to get a better deal on your existing car loan. If you've weighed up the pros and cons and have decided it's the right move for you, visit driva.com.au to get started.